Try Fund Library Premium

For Free with a 30 day trial!

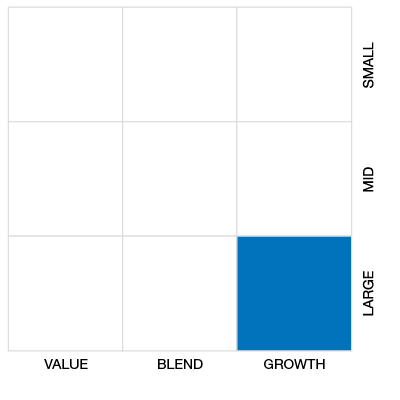

U.S. Small/Mid Cap Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (02-11-2026) |

$10.64 |

|---|---|

| Change |

-$0.09

(-0.88%)

|

As at January 31, 2026

As at December 31, 2025

Inception Return (January 14, 2008): 2.06%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 3.53% | 1.17% | 8.41% | 3.53% | 0.24% | 8.23% | 7.28% | 3.71% | 2.20% | 3.37% | 3.95% | 2.42% | 3.88% | 5.38% |

| Benchmark | 1.73% | 2.68% | 8.45% | 1.73% | 3.22% | 16.92% | 12.55% | 10.15% | 10.04% | 10.62% | 10.88% | 9.95% | 10.07% | 11.15% |

| Category Average | 2.39% | 2.30% | 6.05% | 2.39% | -1.20% | 8.58% | 6.85% | 3.82% | 5.65% | 5.83% | 6.06% | 4.88% | 5.65% | 6.73% |

| Category Rank | 92 / 330 | 232 / 330 | 109 / 306 | 92 / 330 | 100 / 304 | 123 / 272 | 111 / 268 | 119 / 250 | 190 / 244 | 139 / 200 | 160 / 195 | 172 / 182 | 148 / 162 | 124 / 158 |

| Quartile Ranking | 2 | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 4 | 3 | 4 | 4 | 4 | 4 |

| Return % | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -6.69% | -8.81% | -1.97% | 5.82% | 3.83% | 0.89% | 5.32% | 1.41% | 0.33% | -1.09% | -1.21% | 3.53% |

| Benchmark | -5.13% | -6.25% | -5.32% | 5.58% | 3.68% | 3.25% | 2.29% | 2.31% | 0.93% | 1.19% | -0.25% | 1.73% |

14.75% (October 2011)

-24.60% (October 2008)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 12.38% | 11.79% | -10.04% | 17.04% | 6.12% | 10.87% | -23.31% | 15.58% | 10.70% | 0.64% |

| Benchmark | 14.08% | 8.66% | -2.87% | 21.65% | 11.78% | 20.00% | -11.77% | 13.76% | 24.39% | 7.19% |

| Category Average | 9.80% | 10.84% | -7.63% | 15.90% | 4.61% | 23.16% | -17.30% | 11.64% | 13.19% | 1.07% |

| Quartile Ranking | 2 | 2 | 4 | 3 | 3 | 4 | 4 | 1 | 3 | 2 |

| Category Rank | 78/ 158 | 55/ 162 | 149/ 182 | 137/ 193 | 150/ 200 | 239/ 244 | 213/ 250 | 46/ 268 | 179/ 272 | 132/ 301 |

17.04% (2019)

-23.31% (2022)

| Name | Percent |

|---|---|

| US Equity | 93.58 |

| International Equity | 4.65 |

| Canadian Equity | 0.90 |

| Cash and Equivalents | 0.86 |

| Other | 0.01 |

| Name | Percent |

|---|---|

| Healthcare | 23.48 |

| Technology | 20.92 |

| Industrial Goods | 12.08 |

| Financial Services | 11.81 |

| Real Estate | 7.47 |

| Other | 24.24 |

| Name | Percent |

|---|---|

| North America | 95.35 |

| Latin America | 2.80 |

| Europe | 1.80 |

| Asia | 0.06 |

| Name | Percent |

|---|---|

| Comfort Systems USA Inc | 1.74 |

| Piper Sandler Cos | 1.37 |

| Insmed Inc | 1.30 |

| Tapestry Inc | 1.09 |

| Moelis & Co Cl A | 0.94 |

| Rocket Lab Corp | 0.93 |

| Credo Technology Group Holding Ltd | 0.88 |

| Astera Labs Inc | 0.87 |

| Bloom Energy Corp Cl A | 0.86 |

| Tempur Sealy International Inc | 0.84 |

RBC O'Shaughnessy U.S. Growth Fund II Series A

Median

Other - U.S. Small/Mid Cap Equity

| Standard Deviation | 18.12% | 19.11% | 18.78% |

|---|---|---|---|

| Beta | 1.13% | 1.14% | 1.09% |

| Alpha | -0.06% | -0.08% | -0.06% |

| Rsquared | 0.87% | 0.90% | 0.88% |

| Sharpe | 0.27% | 0.06% | 0.28% |

| Sortino | 0.49% | 0.07% | 0.30% |

| Treynor | 0.04% | 0.01% | 0.05% |

| Tax Efficiency | 100.00% | 87.20% | 83.99% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 15.52% | 18.12% | 19.11% | 18.78% |

| Beta | 1.04% | 1.13% | 1.14% | 1.09% |

| Alpha | -0.03% | -0.06% | -0.08% | -0.06% |

| Rsquared | 0.80% | 0.87% | 0.90% | 0.88% |

| Sharpe | -0.07% | 0.27% | 0.06% | 0.28% |

| Sortino | -0.14% | 0.49% | 0.07% | 0.30% |

| Treynor | -0.01% | 0.04% | 0.01% | 0.05% |

| Tax Efficiency | 100.00% | 100.00% | 87.20% | 83.99% |

| Start Date | January 14, 2008 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $15 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| RBF306 |

To provide long-term capital growth. The fund invests primarily in equity securities of U.S. companies based on Strategy Indexing, an investment portfolio management model developed in 1995 by Jim O’Shaughnessy. Strategy Indexing is a rigorous and disciplined approach to stock selection based on characteristics associated with above average returns over long periods of time.

To achieve the fund’s objectives, the portfolio manager: employs a proprietary quantitative approach to security selection based on research and analysis of historical data; screens securities using a factor-based model for attractive value, growth and quality characteristics; screens securities based on financial and governance risk factors; invests in U.S. small- to mid-cap stocks.

| Portfolio Manager |

RBC Global Asset Management Inc. |

|---|---|

| Sub-Advisor |

O'Shaughnessy Asset Management, L.L.C.

|

| Fund Manager |

RBC Global Asset Management Inc. |

|---|---|

| Custodian |

RBC Investor Services Trust (Canada) |

| Registrar |

RBC Global Asset Management Inc. Royal Bank of Canada RBC Investor Services Trust (Canada) |

| Distributor |

Royal Mutual Funds Inc. |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 25 |

| PAC Subsequent | 25 |

| SWP Allowed | Yes |

| SWP Min Balance | 10,000 |

| SWP Min Withdrawal | 100 |

| MER | 2.15% |

|---|---|

| Management Fee | 1.85% |

| Load | No Load |

| FE Max | - |

| DSC Max | - |

| Trailer Fee Max (FE) | - |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | 1.00% |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!